SIGNATURE BANK

BRAND REFRESH, PRODUCT DESIGN, RESEARCH, USABILITY TESTING, DESIGN SYSTEM DEVELOPEMENT & INTEGRATION, BRAND DESIGN, UI DESIGN & UI KIT DEVELOPMENT.

BACKGROUND & GOALS

As a product designer at Interswitch, my primary responsibility was to craft a seamless experience for Signature Bank's mobile app, aligning with their strategic goal of maximizing the digital market. Signature Bank, launched in 2022, aims to empower Nigerians and businesses, collaborating with Interswitch to enhance its financial infrastructure.

To acquire customers and expand its reach across Nigeria, Signature Bank is keen on tapping into the digital landscape. Their mobile banking application is designed to facilitate account opening, request/collecting bank cards, and providing other account management services, all without the need for physical visits to a bank branch. This approach is pivotal for the bank's growth as it targets digitally savvy Nigerians, creating a community of early adopters.

My role in this endeavor was instrumental in creating a user-centric design that not only meets Signature Bank's objectives but also resonates with the digitally aware Nigerian audience. This strategic focus on technology-driven banking services reflects a significant shift in the banking landscape, and my design work aimed to provide a smooth and intuitive user experience that caters to the needs of this evolving market.

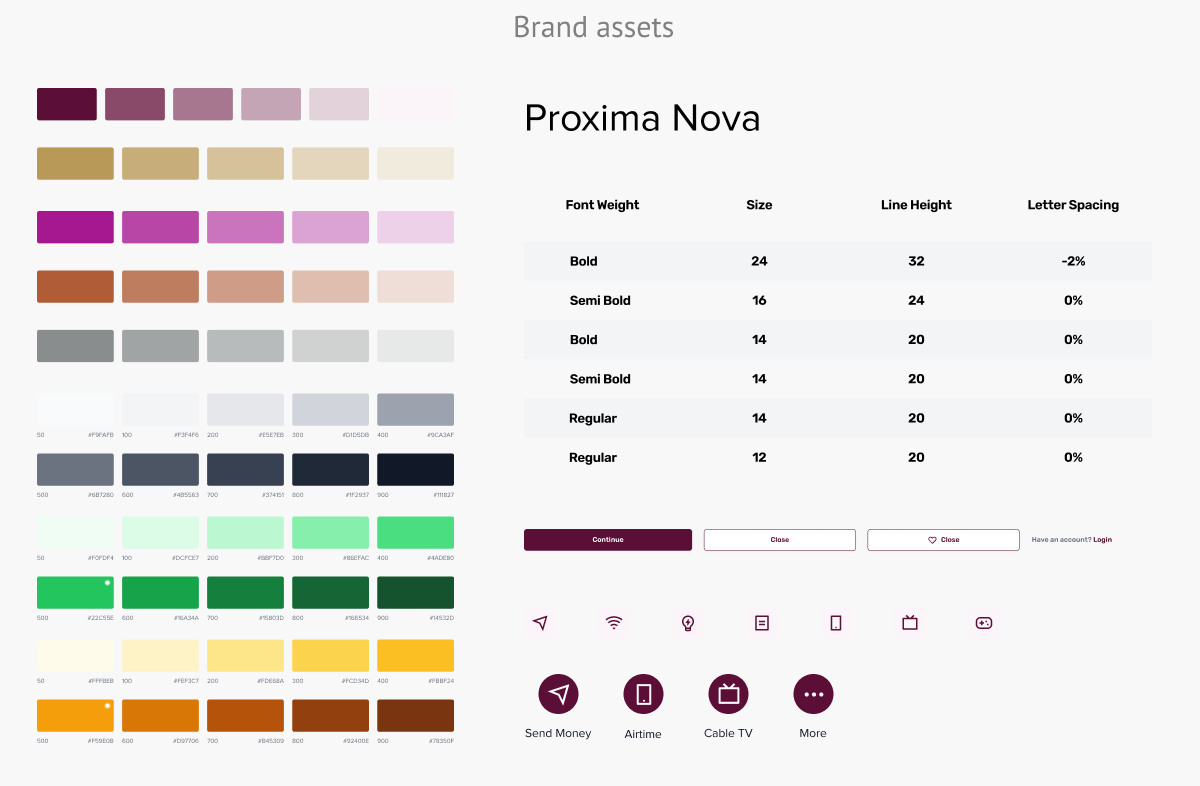

BRANDING ASSET & UI KIT

As new bank, it is important that every brand touchpoint must be consistent and in alignment. To create a products that aligns, we created a UI Kit which aligns with the bank's branding. This could also be seen beyond just the aesthetics, The messaging in app were also a touchpoint to achieve brand consistency

ONBOARDING & DASHBOARD

By progressively verifying more details, users unlock enhanced account privileges. This nuanced approach caters to both user convenience and regulatory requirements. Meanwhile, the dashboard mirrors this user-centric philosophy, affording swift access to the most commonly used services. This strategic design resonates with Signature Bank's ambition to captivate digitally inclined Nigerians and cultivate a community of tech-savvy early adopters.

Engineered to facilitate user onboarding and identity verification sans the need for physical bank visits, this feature adopts a strategic approach. It aims to simplify and gamify the process by chunking down the information collection into manageable sections, thereby expediting account opening without compromising transaction capabilities. The user's journey is carefully calibrated to encourage gradual and comprehensive provision of KYC and personal information, translating into tiered access to banking services.

SENDING MONEY

Enabling effortless money transfers to any bank within Nigeria, this feature prioritizes simplicity, efficiency, and user-friendliness. Crafted to be intuitive and time-saving, it empowers users with a seamless experience for sending funds to diverse destinations. This design approach reflects our commitment to providing hassle-free financial interactions that cater to users' convenience and needs.

CARD CENTER

The Card Centre stands as a valuable service that empowers users to seamlessly request and manage all bank cards linked to their account. This eliminates the need for users to physically visit a bank branch for card-related tasks. A new bank card can be effortlessly requested in just 3 clicks. The user's experience is further streamlined as they can activate a new card and even generate virtual cards, all achieved within 2-4 clicks on the app. This innovative approach underscores our commitment to simplifying and enhancing user interactions, while delivering essential banking services conveniently.

PAYING BILLS

With a few step or clicks users can pay for bills like data, airtime, electricity, Cable TV and more with few minutes.

TOKEN MANAGEMENT

To bolster account security, we've introduced Tokens as a two-step authentication service for authorizing transactions surpassing specified limits. Unlike the traditional approach of physically obtaining these devices from a bank branch, Signature Bank empowers users to effortlessly request hard or soft tokens at their fingertips. The process is streamlined to just 2-3 steps, allowing users to make requests directly from the app. This innovation eliminates the need to visit a physical branch, alleviating stress and enhancing user convenience.

PROTOTYPE

A glimpse of the user's experience