MOUNAE

BRAND IDENTITY, BRANDING, PRODUCT DESIGN, RESEARCH, USABILITY TESTING, PRODUCT DEVELOPMENT AND MANAGEMET

ABOUT THE PRODUCT

Mounae is a financial management app designed to give Nigerians a birds-eye view of their finances so they can make better financial decisions and achieve financial goals. Mounae provides different financial services incorporated into one app.

RESEARCH

In August 2019, we embarked on a comprehensive survey to delve into user behaviors concerning existing financial tools within Nigeria and identify areas for improvement. Despite numerous fintech applications in the market, only a handful addressed financial management adequately. Many fell short due to their inability to provide users with the fundamental tools they required. Our findings illuminated critical insights on the user side:

- 80% Demand for Efficient Financial Management: An overwhelming 80% of users expressed the need for a robust financial management tool

- Varied Tracking Methods: 30% relied on spreadsheets, while 40% resorted to mobile applications from app stores to track personal expenses and income.

- Manual Input Challenges: All mobile applications observed had a manual data input process for expenses and income, a factor that users found cumbersome.

- Data Inaccuracy Concerns: A striking 87% of users confessed to forgetting to input data regularly, compromising the accuracy of analyzed information.

- Seamless Tracking Desire: The universal desire among users was for an easy, seamless method to track income and expenses.

In analyzing the competitive landscape, it was evident that:

- Limited Scope in Fintech:All available financial management tools primarily focused on savings and investment options within Nigeria's fintech market.

- Lack of Seamless Tracking Solutions:No domestic application catered to seamless income and expense tracking.

- Foreign Applications Inadequate for Nigerian Users:Foreign applications with income and expense tracking did not cater to the specific needs of Nigerian users.

- Gap in Financial Analysis: Notably absent was an application that facilitated financial analysis for users.

Armed with these insights, we identified a significant opportunity to revolutionize the Nigerian fintech landscape by creating Mounae—a unique, all-encompassing solution addressing income and expense tracking, seamless user experience, and advanced financial analysis capabilities

SOLUTION

Recognizing the need for a truly effective financial management tool, we were driven by the belief that comprehensive coverage was the key to delivering value to individuals' finances. Our approach was to stand out by offering users the complete spectrum of financial management benefits, ensuring that they could harness the full potential of their financial resources. This commitment to holistic financial empowerment underpinned our mission to redefine the financial management landscape and provide users with a tool that exceeded their expectations.

BRAND ASSET

Brand Colors

BRAND TYPOGRAPHY

Montserrat

DASHBOARD

We meticulously designed this feature to empower users with seamless navigation throughout the app. Our design prominently showcases every financial service that Mounae offers, ensuring users can effortlessly access these essential tools. Moreover, this interface provides an insightful overview of each service, enabling users to swiftly grasp the essence of various facets of their financial landscape. Our aim was to enhance user convenience, facilitate exploration, and offer a swift grasp of their financial standing.

BANK ACCOUNTS

Crafted to streamline user experience, this feature enables users to seamlessly authorize their Mounae account to access real-time bank statements. The objective is to eliminate or minimize the need for manual entry of expenses and income, a process that often proves time-consuming and prone to errors. By establishing this direct connection, users can harness the power of automated data retrieval, significantly enhancing the accuracy and efficiency of their financial management. This design approach underscores our commitment to simplifying financial tracking and amplifying user convenience.

FINANCIAL PLANNING

This feature is meticulously designed to empower users in planning their financial goals, spanning from monthly budgets to specific expenses or projects. Furthermore, it facilitates ongoing monitoring and management of these financial objectives. By offering a structured framework for goal setting, tracking, and optimization, this feature enables users to achieve greater financial control and realize their aspirations with heightened precision and efficiency. Our design approach underscores our dedication to fostering user empowerment and strategic financial management

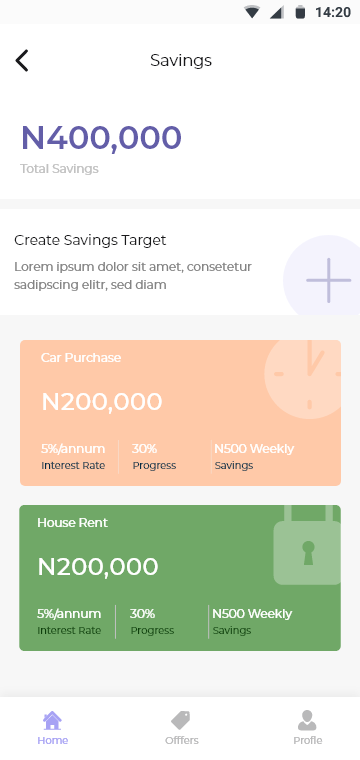

SAVINGS AND INVESTMENTS

Delicately designed to foster a culture of savings and investment, this feature serves as a guiding beacon for users on their journey toward financial freedom. By inspiring proactive financial decisions and providing accessible pathways to savings and investment opportunities, our design intends to empower users with the tools and resources needed to secure their financial future. This feature stands as a testament to our commitment to promoting long-term financial well-being and cultivating a sense of financial empowerment among our users.

FINANCIAL ANALYSIS

This feature has been thoughtfully designed to empower users with a clear comprehension of their spending habits. By analyzing both expenses and income, it offers valuable insights into their financial patterns. Our design approach is geared towards providing users with a comprehensive view of their financial behaviors, enabling them to make informed decisions and ultimately take control of their financial well-being. This feature exemplifies our commitment to equipping users with the tools they need to better manage their finances.