MKOBO

BRAND REFRESH, PRODUCT DESIGN, RESEARCH, USABILITY TESTING, DESIGN SYSTEM DEVELOPEMENT & INTEGRATION, BRAND DESIGN, UI DESIGN & UI KIT DEVELOPMENT.

BACKGROUND & GOALS

Within the Nigerian banking sector's substantial $9 billion value pools, a significant challenge persists – a vast majority of consumers remain underserved. Despite intense competition, issues like limited access in rural areas, affordability barriers, and subpar user experiences compound customer frustrations across the board, as highlighted by McKinsey & Company.

To drive Nigerian banking sector growth and address these challenges, Mkobo Microfinance Bank embarked on a mission. Their objective: rebranding and providing accessible, uncomplicated financial services. By 2026, they aspire to enrich the lives of 10,000,000 everyday Africans, chiefly economically active Nigerians and salary earners, through the creation of a digital bank.

In my role as Product Design Lead within a 20 member Product Development team, I spearheaded various key initiatives. These encompassed Mkobo's Brand Revitalisation, Product Design, User and Product Research, and User Testing. Through this comprehensive approach, we aimed to not only transform Mkobo's image but also ensure the provision of user-centric, effective financial solutions that truly empower the Nigerian population.

BRAND REVITALISATION

I played a pivotal role in the comprehensive brand revitalization process. This initiative aimed to contemporize our corporate image and forge stronger connections with our dual audience of borrowers and investors.

As an integral member of the team, I made substantial contributions to the evolution of our visual identity, which involved a complete overhaul of our logo and website. While we preserved some recognizable elements from the previous logo to maintain brand continuity, we infused it with a fresh, modern, and approachable aesthetic. This transformation incorporated vibrant colors and a simplified design, infusing newfound vitality into our brand's identity and visibility.

To ensure consistent application of these refreshed brand elements across diverse digital and traditional channels, we embraced a flat design approach with a single primary color for the logo mark. This meticulous attention to detail bolstered our brand's presence and resonance across various platforms, reinforcing its impact on our target market

The website underwent a comprehensive redesign, prioritizing user-friendliness, mobile responsiveness, and alignment with our updated messaging. In tandem, I played a pivotal role in shaping our brand's messaging strategy. We carefully crafted a narrative that underscored our unwavering commitment to financial inclusion, microfinance innovation, and customer-centricity. This messaging seamlessly permeated all our communication channels, from our website to social media platforms.

The brand refresh proved to be a game-changer for Mkobo, allowing us to cast a wider net and attract a younger, tech-savvy clientele while preserving the trust of our existing customer base. The revamped visual identity and messaging effectively conveyed our dedication to progress and financial empowerment. In sum, this undertaking was an unequivocal success, contributing significantly to Mkobo's growth and strengthened market positioning.

PRODUCT DESIGN

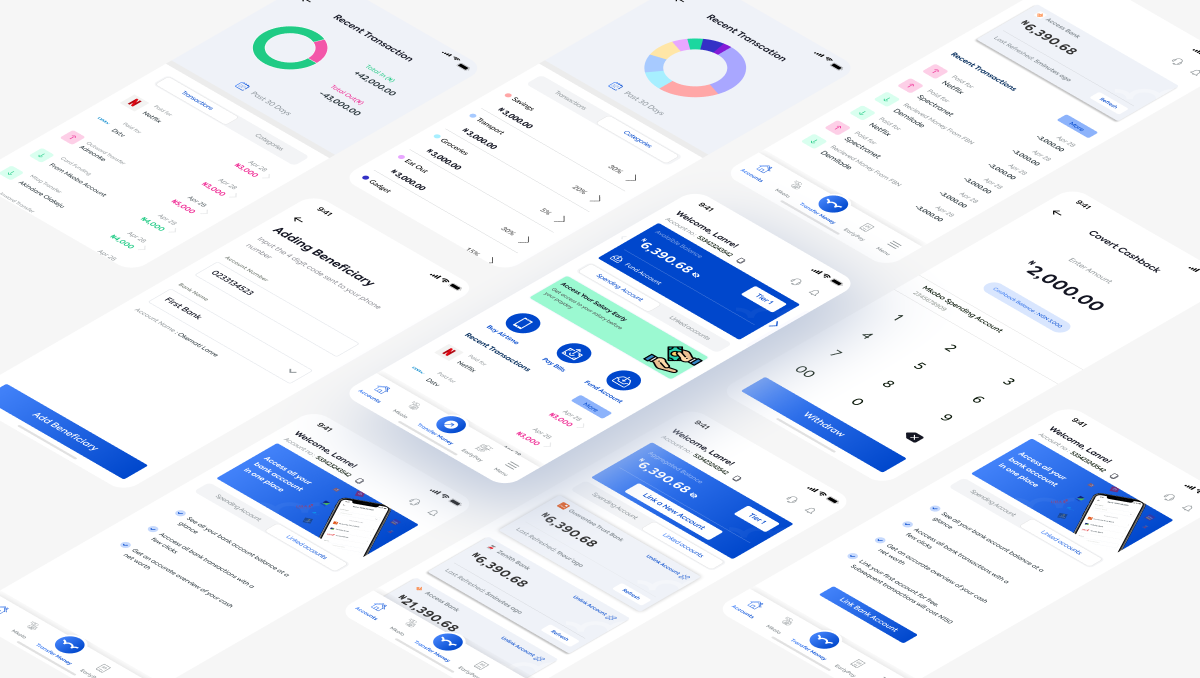

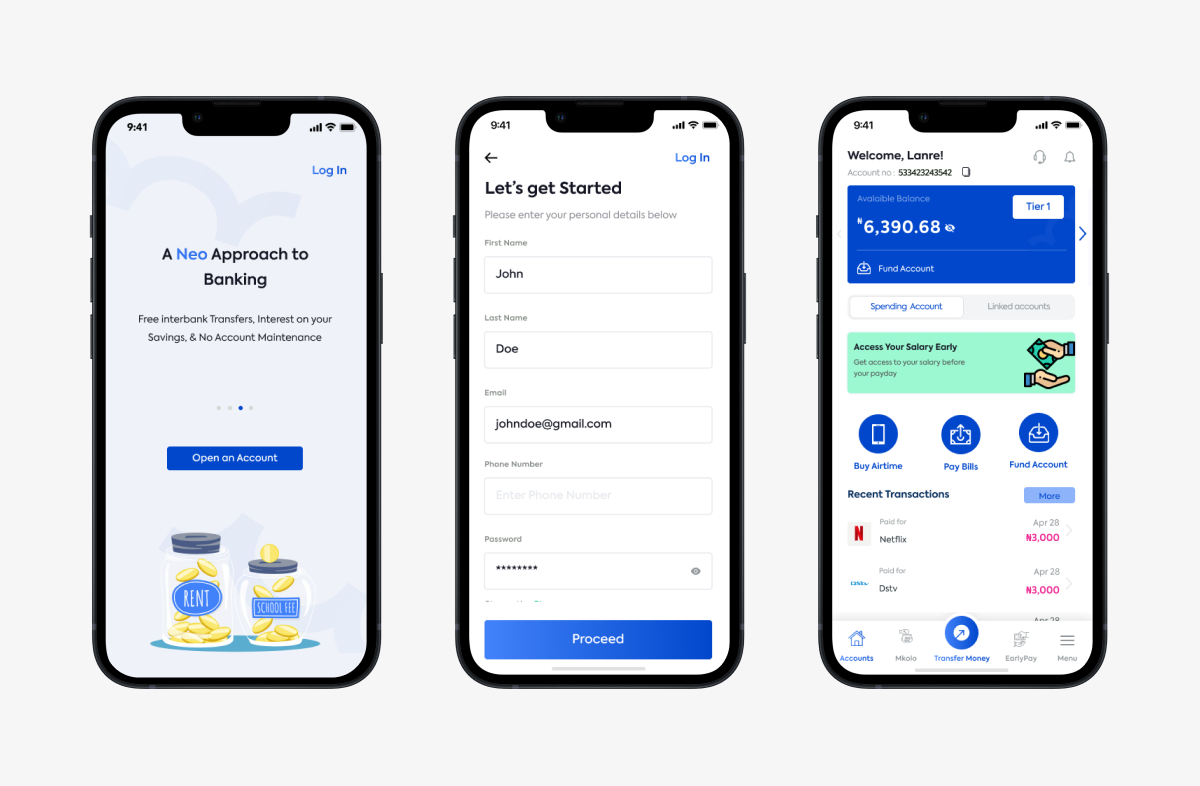

Mkobobank stands as a digital banking solution tailored for economically active Nigerians and salaried individuals. Seamlessly accessible, it empowers users to effortlessly open bank accounts, conduct swift money transfers, and settle bills within mere minutes, irrespective of global location. Physical bank visits are rendered obsolete.

Distinguished by its innovative services, Mkobobank introduces an array of unique offerings. These encompass linked accounts, Mkolo, Mtag, Payme, and Earlypay, ensuring a comprehensive suite of financial tools to cater to diverse needs.

USER PERSONA

This describes the typical target audience of the Mkobo digital bank

INFORMATION ARCHITECTURE

We created this for each feature to help guide design decisions. The sample shown below is for the onboarding flow

LOW-FIDELITY DESIGN

A low fidelity prototype that helped us in validating and design integration process

ONBOARDING

Crafted with the user in mind, our design aims to streamline the bank account opening process to a mere 5 minutes. We've meticulously curated the onboarding journey to gather only essential information, swiftly verifying identity in near-instant fashion. The onboarding flow prioritizes simplicity and seamlessness, ensuring users can effortlessly establish a bank account. This can be achieved through the provision and verification of their BVN or even via an existing bank account, making the experience remarkably accessible and user-friendly

PAYING BILLS

Our service empowers users to conveniently settle bills for airtime, internet data, electricity, and various expenses in Nigeria. We've honed the "Pay Bills" feature to facilitate payments with utmost efficiency, accomplished in a mere 4 to 6 clicks. For added convenience, users can also save payment information, streamlining the process to a mere 3 clicks. This design reflects our commitment to minimizing hassle and optimizing user experience in bill payments.

SENDING MONEY

With a relentless focus on maintaining a seamless and effortless interface, we've crafted a user-friendly feature enabling money transfers within a mere 3 to 4 steps. Furthermore, we've introduced a groundbreaking service named Mtag, redefining money transfers. Mtag empowers users to effortlessly send money to friends, family, or anyone within the Mkobo bank ecosystem using just a unique username. This innovation aims to forge a personal connection with our users, allowing them to personalize their Mtag and thus enhancing their overall experience and engagement with the platform.

EARLYPAY

Introducing an earned wage access service tailored for salary earners, providing them the ability to access up to 50% of their earned wage. Our interface is meticulously designed to ensure fund access within a mere 3-4 steps, maximizing simplicity and user-friendliness.

The dashboard layout is thoughtfully crafted to offer users a comprehensive snapshot of crucial information. This includes the accessible amount, outstanding figures, limits, accrued salary, and transaction history. To prevent information overload, we've strategically employed colors and element sizes, guiding users' focus to key details. For instance, the card housing details like available withdrawable amount, accrued salary, limits, and work days employs a well-defined information hierarchy. The "available to withdraw amount" takes center stage, bolstered by its size and color, ensuring it stands out as the primary focal point. This design philosophy enhances user experience by facilitating effortless navigation and immediate comprehension of vital financial data.

PAYME

This service empowers users with a remarkable ability to request funds from anyone, anywhere, using two seamless methods. Users can effortlessly initiate requests by either sharing a link or directly requesting from fellow Mkobo users through Mtag.

The process is straightforward: users can choose recipients from their list of saved beneficiaries or simply input a new Mtag to send out a request. This innovative feature optimizes convenience and flexibility, allowing users to manage their financial interactions with ease and efficiency.

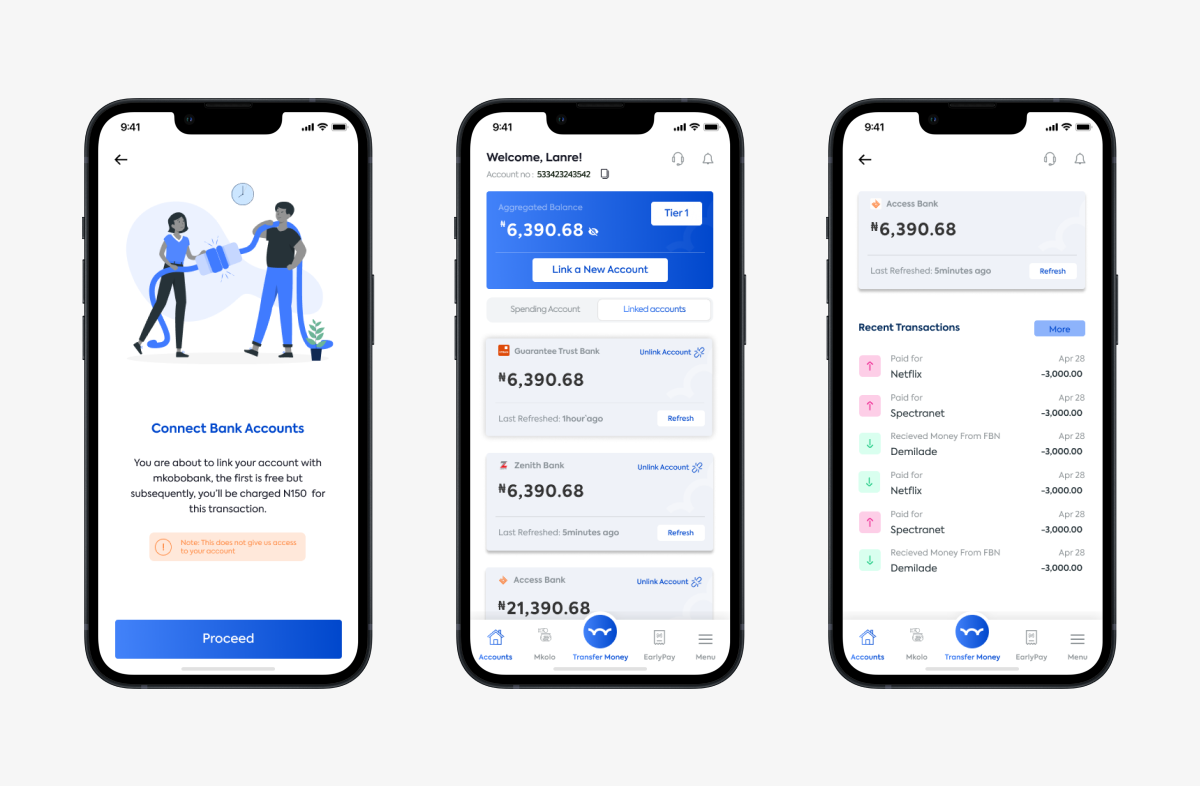

LINKED ACCOUNT

Acknowledging that an economically active Nigerian often maintains at least two bank accounts, we crafted a unique service to cater to this reality. Our innovative approach grants users the capability to access the balances and transactions of their multiple bank accounts through Mkobo. This seamless integration empowers users to view their financial status across various accounts, making Mkobo bank the ultimate financial companion for our users. By extending this service, we aimed to solidify our position as the trusted partner that ensures a comprehensive overview of users' financial landscape, fostering a strengthened bond with every individual we serve.