GKALA

BRAND REFRESH, PRODUCT DESIGN, RESEARCH, USABILITY TESTING, DESIGN SYSTEM DEVELOPEMENT & INTEGRATION, BRAND DESIGN, UI DESIGN & UI KIT DEVELOPMENT.

BACKGROUND & GOALS

In a bid to enhance financial inclusion in Nigeria, the Central Bank of Nigeria (CBN) sanctioned the establishment of three new Payment Service Banks (PSBs) on August 27, 2020. These entities are set to address the gaps in financial access. Among the approved institutions is Moneymaster PSB, a subsidiary of Glo, Nigeria’s second-largest telecom company.

PSBs are authorized to provide high-volume, low-value services encompassing remittances, micro-savings, and withdrawals. These services are primarily aimed at underserved regions and communities lacking banking access. A prerequisite for PSBs is maintaining a minimum of 25% physical presence in rural areas, involving ATMs and point of sale devices.

Interswitch, a leading financial infrastructure provider in Africa, collaborated with Moneymaster PSB to furnish it with robust financial infrastructure. In this context, I was entrusted as the primary designer, responsible for managing the design process for its personal and corporate Internet banking applications, spanning mobile and web platforms.

The objective for Gkala (the personal banking mobile app) was to establish a bank accessible and manageable solely through a registered Nigerian mobile number. Leveraging the Nigeria Communications Commission's directive linking mobile numbers to National Identification Numbers (NINs) and Bank Verification Numbers (BVNs), this goal was feasible due to Moneymaster's affiliation with Glo, granting access to NIN-linked mobile numbers. This strategic approach aimed to facilitate financial inclusion and broaden banking services reach, especially in rural and underserved areas.

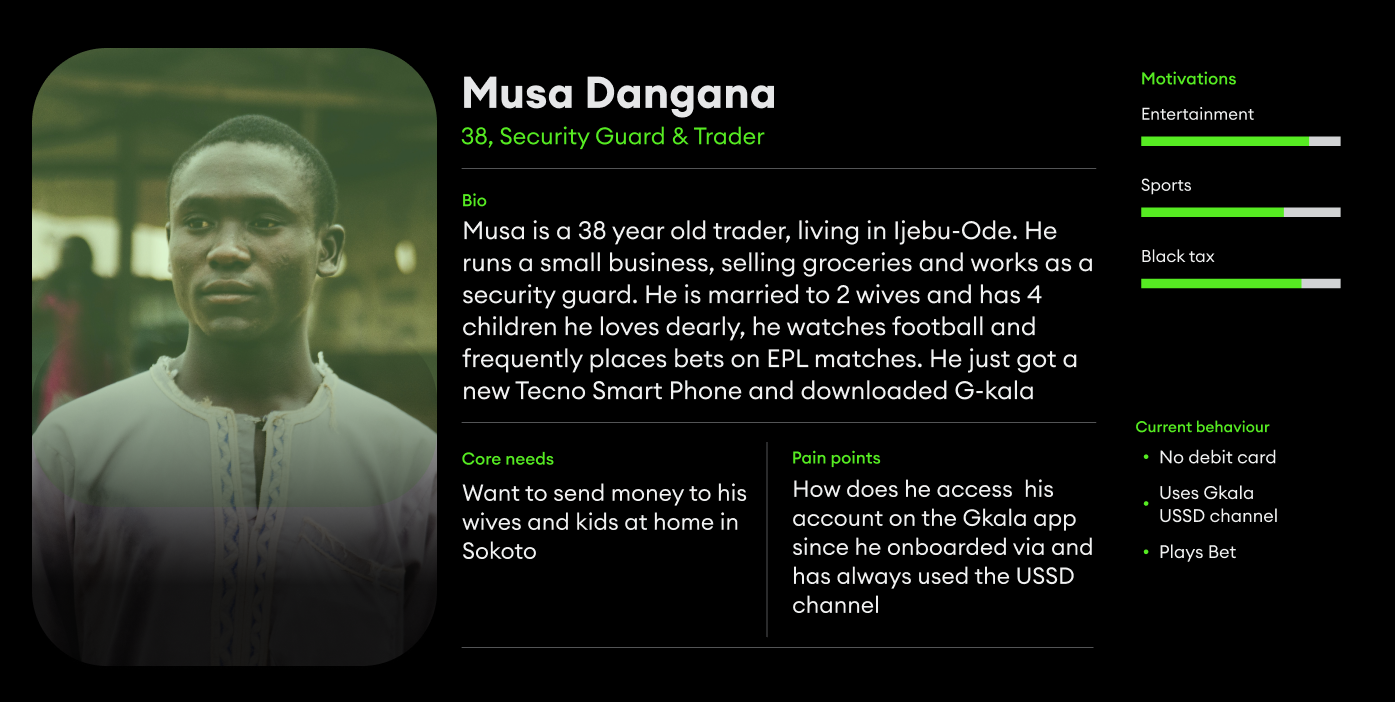

USER PERSONA

As part of defining our target audience, I crafted user personas to establish a clear understanding of our users. One of these personas centers on guiding users who are transitioning from the USSD channel, often designed for individuals without smartphones, to become adept smartphone users. This persona aims to facilitate a seamless user journey as they adapt to the digital banking experience.

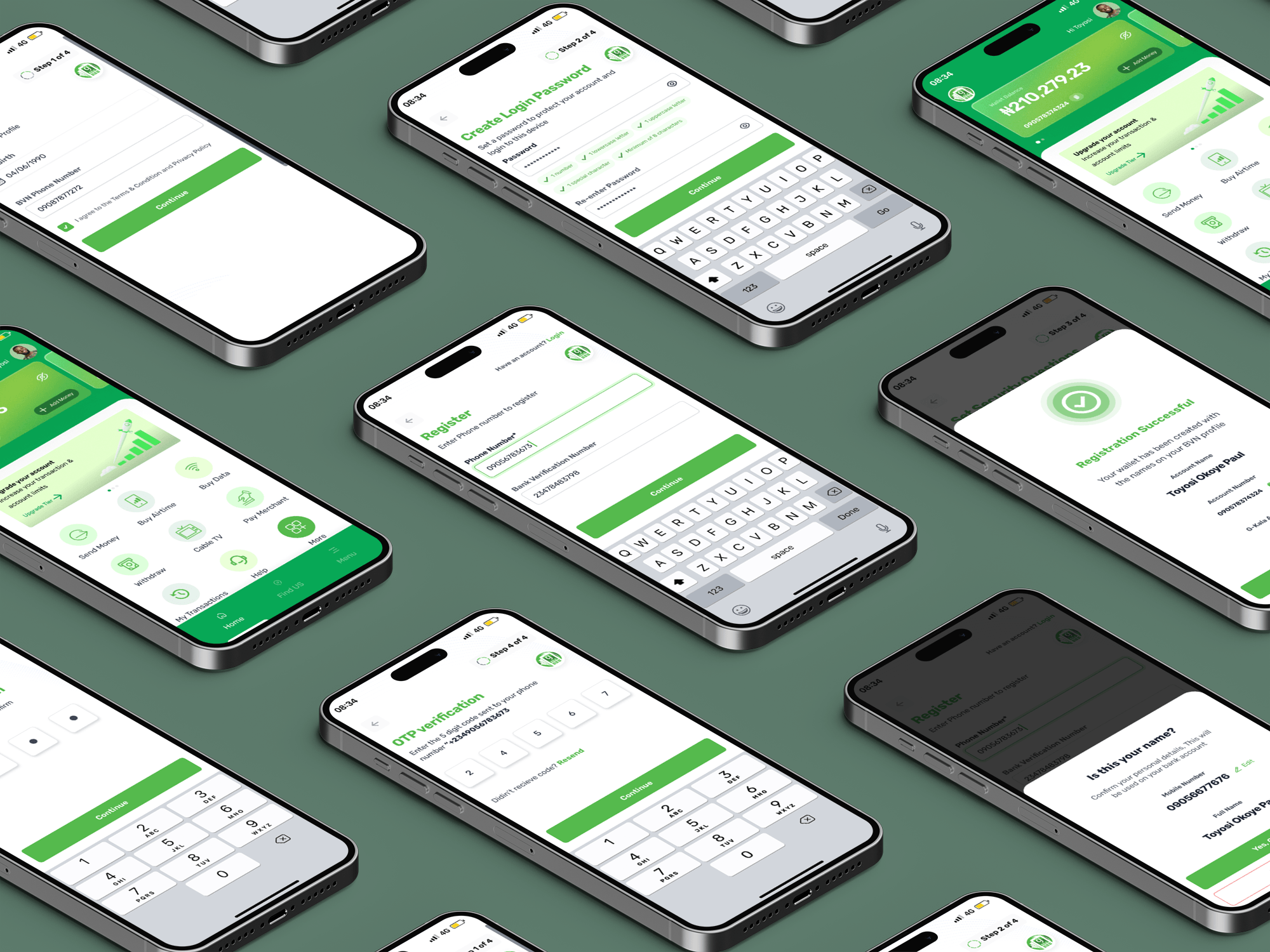

ONBOARDING & ACCOUNT OPENING

To ensure a smooth onboarding process, we've streamlined it to be effortlessly swift. Users need only provide their Glo mobile number to get started. In cases where the user isn't a Glo customer, they can easily verify their BVN profile data. This approach enables new users to open an account within a mere 5 minutes, offering a frictionless experience that emphasizes simplicity and efficiency.

DASHBOARD, FIND US, & MENU

The dashboard has been meticulously designed to align with the most common daily transactions performed by an average Nigerian. It offers easy access to these frequently used actions while ensuring that the user can quickly attend to other transactional needs. To prioritize the most critical aspect of one's bank account, the account balance card is prominently displayed, ensuring users are always aware of their balance.

Recognizing the absence of physical branches and ATMs, Moneymaster has introduced Gkala agents located strategically across Nigeria. These agents serve as cash points for the bank's customers. To facilitate easy access, we've incorporated a "Find Us" feature, which assists users in locating and obtaining directions to the nearest Gkala agent. This design approach optimizes user experience by enhancing accessibility and convenience in every interaction with the platform.

SENDING MONEY

Facilitating effortless money transfers, this feature empowers users to send funds to Gkala accounts, accounts at other banks, and even phone numbers, all within a few seamless steps. To alleviate the complexities of transferring funds, I engineered a streamlined flow that anticipates the recipient's bank, sparing users the hassle of navigating an extensive list of all banks in Nigeria. This design innovation significantly reduces the steps involved in sending money, offering a more efficient alternative compared to the existing processes in the market.

PAYING BILLS

Empowering users with the capability to conveniently settle bills such as airtime, data, electricity, cable TV, and beyond, this feature revolutionizes the bill payment process. Designed for utmost efficiency, users can settle bills in a mere 3-4 clicks. Additionally, the functionality enables users to save beneficiaries for future use, minimizing the effort required for subsequent payments. This design approach aligns with our commitment to optimizing user experience and simplifying financial interactions.

USABILITY TESTING & DESIGN VALIDATION

To rigorously validate the effectiveness of our designs, we executed an unmoderated usability test involving 15 users. The outcomes, as depicted in the screenshot of the report below, shed light on key insights and user experiences that informed our design iterations. This meticulous approach underscores our commitment to creating user-centric solutions that are both intuitive and impactful.

PROTOTYPE

To get a feel of users interaction with the application, kindly use the prototype below